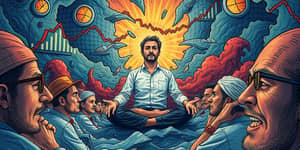

In a world overwhelmed by market chatter, learning to distinguish fleeting distractions from lasting value is the key to investing success.

Every day, investors are bombarded with 24/7 financial media headlines and hot takes that promise to predict the next big move. Yet most of this content represents noise—short-term, low-information drivers that rarely improve decisions.

In contrast, true signal comes from fundamentals: long-term corporate earnings, durable competitive advantages, and rational capital allocation. While noise tempts us into impulsive trades and emotional reactions, signal grounds us in what drives wealth over decades.

Investment noise has many faces. Attention algorithms reward the dramatic over the accurate, creating a feedback loop that fuels fear, greed, and FOMO. TMA Investment calls these accumulations of external and internal distractions the greatest obstacle most investors face.

This noise often drives the worst behavior: buying at peaks and selling at troughs. Recognizing these psychological traps is the first step toward a disciplined approach.

Headlines can create misleading narratives. Consider a report about a North Carolina bridge project being “defunded” that sharply moved certain stocks. In truth, only a minor grant was pulled, leaving the project largely intact. Investors who look past headline risk and focus on long-term cash flow potential found opportunity.

Policy shifts, tariff announcements, and crypto hype often dominate discussions yet have highly specific, limited impacts on long-run business value. By distinguishing between what’s talked about and what truly affects earnings, you can avoid overreacting to every breaking story.

Academic research on noise trader theory reveals that speculators who trade without regard for fundamentals create mispricing that disciplined managers can exploit. In Stambaugh’s work, as noise traders’ market share declines, mispricing shrinks and alpha becomes harder to find.

This dynamic underscores that noise is not just annoying—it can be a source of opportunity, but only if you remain focused on evidence rather than emotion. As indexing grows and markets professionalize, the value of staying signal-focused increases even further.

Evidence shows that a handful of factors determine most portfolio outcomes over decades. By concentrating on these drivers, you cut through the distraction and build resilience.

Imagine portfolio returns as sound waves. Volatile assets like stocks produce loud peaks and valleys, while cash is a quiet, low-volume signal. There are two strategies to manage risk:

By combining volatile but low-correlation assets—such as stocks and gold—you can create a portfolio whose overall “loudness” is lower than any single component. The Golden Butterfly is a classic example: five volatile assets, yet overall volatility is muted through diversification.

To put these ideas into action, follow a clear, step-by-step framework that emphasizes structure over reaction.

Markets will always be noisy in the short run, driven by sensational headlines, emotional reactions, and speculative trading. But over time, markets are surprisingly orderly, rewarding those who focus on what truly matters: fundamentals, structure, and behavior.

By filtering out distractions, adopting a noise-cancelling approach to portfolio construction, and staying committed through market cycles, you position yourself to capture the signal—the lasting growth in value that builds wealth across decades.

References