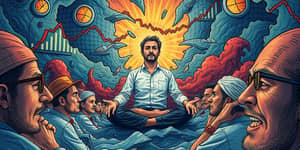

Investing often feels like a roller coaster of emotions, but a SWAN portfolio brings serenity by prioritizing stability over speculation.

A Sleep-Well-at-Night (SWAN) portfolio is designed to minimize stress and volatility so investors can preserve capital and pursue steady growth. Instead of chasing highest returns, it focuses on long-term compounding and resilience even when markets tumble.

Key principles include risk-return balance tailored to you, diversification spreads risk effectively, and a patient, evidence-based approach. Experts like Seth Klarman remind us that nothing is more important than the ability to rest undisturbed after a day of investing.

A SWAN portfolio blends growth, income, liquidity, and downside protection. Each allocation reflects personal goals, age, and risk tolerance. Below is a summary of core asset classes and why they matter.

Optional allocations may include dividend stocks for income or even a small crypto position if it aligns with your personal risk tolerance and goals.

Creating a strategy that lets you rest easy demands clear, disciplined action. Follow these essential steps:

Financially, a SWAN portfolio aims to beat inflation while minimizing the chance of permanent capital loss. You gain a smoother ride with reliable income streams and a safety net for emergencies.

Psychologically, lower stress fosters better decision making. You’ll experience enhanced creativity and focus when you’re not obsessing over daily market swings.

On the lifestyle front, having a plan that survives downturns means you can focus on your passions, family, and career without constant portfolio checking.

No strategy is risk-free. Even diversified portfolios can lose value in severe markets. Recognize that past performance does not guarantee future results.

Personalization is crucial—copying another’s allocation may leave you exposed. Always adjust for your capacity to endure drawdowns.

Be wary of overly complex hedges or high-fee products. Simple, low-cost instruments often deliver the best resilience over decades.

Investing wisdom teaches that true success balances gains with peace of mind. As investor David Tepper said, “My value at risk limit is can I sleep at night.” That sentiment captures the essence of a SWAN approach.

Ed Wachenheim reminds us “It is important for a portfolio manager to sleep well at night.” And Christopher Tsai adds that focusing on intrinsic value and patience lets the power of time and compounding work in your favor.

By prioritizing security, diversification, and a long-term perspective, you build not just wealth but confidence. Embrace the SWAN portfolio as a disciplined framework for lasting financial health and emotional well-being.

References