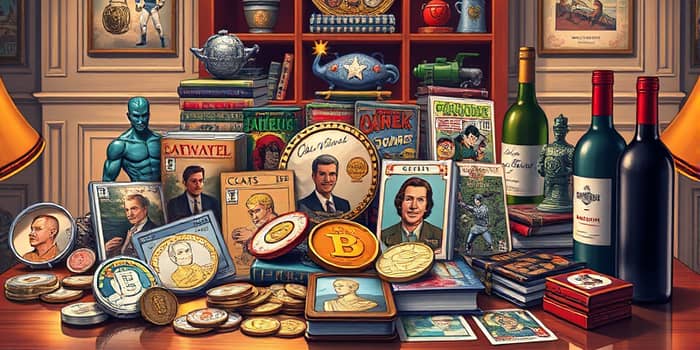

In today’s rapidly evolving investment landscape, collectibles have emerged as both a passion and a serious financial opportunity. Whether you’re drawn by the allure of a perfectly preserved comic book or the historical importance of a rare coin, the world of collectibles offers a unique blend of tangible assets with lasting value.

As we move into 2025 and beyond, this sector is poised to continue its remarkable expansion, fueled by nostalgia, cultural significance, and innovative technology. Below, we dive deep into the forces driving the market and offer practical guidance for collectors at every level.

The global collectibles market reached an astonishing $448.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% through 2032. Meanwhile, the second-hand segment alone was valued at $142.5 billion in 2024 and is set to climb to $248.9 billion by 2034 (CAGR 6.4%).

This surge reflects a broader shift toward sustainable, affordable, and unique investments with emotional resonance. Collectibles are no longer niche interests; they’re becoming mainstream assets that rival traditional holdings in both performance and appeal.

From timeless artifacts to pop-culture treasures, certain categories stand out for their growth potential and enduring charm. Below is a summary of the fastest-growing segments and what makes them so compelling:

Collectors cite several powerful motivations that go beyond financial returns. Chief among them are nostalgia, rarity, and the emotional connection to treasured items. Holding a piece of history or a cultural icon can be deeply satisfying, creating a dual benefit of enjoyment and potential profit.

Technology has democratically expanded the collectibles market. Platforms like eBay, StockX, Heritage Auctions, and VeVe have streamlined buying, selling, and grading, offering global reach and transparent pricing.

Blockchain and NFT authentication tools further reduce counterfeits, while social commerce apps connect collectors worldwide. This integration of technology ensures that even newcomers can navigate the market with confidence.

While many categories have outperformed traditional assets, the market is not without risks. High-end blue-chip items often “fly to quality” during downturns, but volatility remains significant, as values can shift based on trends, media buzz, and economic cycles.

Moreover, collectors must account for storage, insurance, and maintenance costs. Expertise in authentication, grading, and provenance is crucial—an undetected forgery can wipe out potential returns.

Digital collectibles are on the rise, with NFT comic books and unique digital art attracting both speculators and fans. Movie and music memorabilia remain hot, especially one-of-one items tied to legendary figures.

As Gen Z and millennial investors enter the arena, expect further innovation in authenticity verification, community-driven marketplaces, and sustainable second-hand channels. The narrative value of each piece—its story, impact, or rarity—will only grow more central to its worth.

Getting started in collectibles investing can feel overwhelming. Here are actionable steps to build a strong foundation:

The collectibles market offers an exciting intersection of passion, culture, and investment potential. With a global value in the hundreds of billions and growing, it’s clear that these tangible treasures are more than mere hobbies—they’re a dynamic asset class.

By understanding market dynamics, leveraging technology, and applying diligent research, collectors at every level can find both personal joy and financial reward. Whether you’re drawn to the gleam of a rare coin or the vibrant art of a first-edition comic, the world of collectibles awaits with stories to tell and opportunities to seize.

References