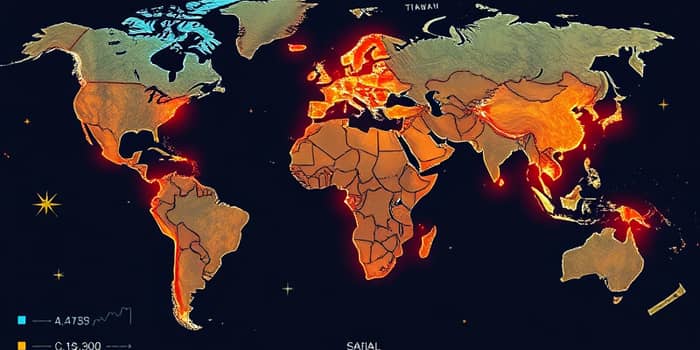

In an age where political upheavals can ripple across global markets within hours, investors face an unprecedented level of uncertainty. Recognizing the impact of global tensions on portfolios is no longer optional—it’s essential for long-term success. This comprehensive guide explores the most volatile regions, outlines critical economic trends, and offers actionable strategies to safeguard assets against turmoil.

The ongoing hostilities between Ukraine and Russia remain one of the most destabilizing events in Europe. Despite periodic ceasefire talks, the conflict’s trajectory is unpredictable, with civilian infrastructure and energy supply lines under constant threat.

Investment Risks:

For investors, monitoring diplomatic developments and energy futures is key to anticipating market swings driven by this conflict.

With the potential collapse of the Assad regime, heightened tensions between Iran and Israel, and proxy engagements across the region, the Middle East stands as a perennial hotspot. These dynamics can trigger sudden oil price surges and disrupt shipping through strategic chokepoints.

Investment Risks:

Staying informed on OPEC decisions and naval deployments helps investors maintain a resilient energy allocation in their portfolios.

China’s assertive military maneuvers around Taiwan have elevated the risk of accidental confrontations. The U.S. “porcupine” deterrence strategy adds another layer of complexity, intertwining defense commitments with semiconductor supply considerations.

Investment Risks:

Maintaining alternative sourcing channels and tracking defense alliance developments can help mitigate sudden shocks to tech-heavy portfolios.

North Korea’s deepening defense ties with Russia and continued missile tests have raised alarms in East Asia. Even low-intensity provocations can unsettle regional markets, particularly in South Korea and Japan.

Investment Risks:

Investors should conduct rigorous country risk analysis when evaluating exposure to Northeast Asian equities and debt.

The Sahel region faces growing extremist presence, threatening mining and infrastructure projects. Political fragility in Mali, Niger, and Burkina Faso poses security challenges for on-the-ground operations.

Investment Risks:

Engaging with local partners and securing robust security protocols are crucial for any investment in high-risk zones.

Beyond flashpoints, three broader trends are reshaping the investment landscape.

Protectionism and Trade Disputes: Since 2022, over 3,000 new trade measures—tariffs, subsidies, export controls—have been enacted. Companies and funds must diversify supply chains and bolster cybersecurity to counter growing trade barriers.

Geoeconomic Confrontation: Sanctions, investment screenings, and financial restrictions have become routine policy tools. Nearly one-quarter of risk professionals now cite state-based conflict as the top threat for 2025, underscoring the need to monitor sanction lists and compliance frameworks.

Globalization vs. Fragmentation: While global cooperation remains vital, rising nationalism and divergent trade strategies threaten to fragment markets. Investors can seize resilience by exploring service-oriented sectors and high-growth emerging markets.

To navigate the volatile global environment, adopt a multi-faceted strategy grounded in analysis, diversification, and adaptability.

Practical implementation involves three key steps:

In a world where a single geopolitical flashpoint can shake global markets, proactivity is paramount. By identifying high-risk regions, understanding macro trends, and employing robust investment strategies, investors can transform uncertainty into opportunity. Vigilant monitoring, strategic diversification, and agility will define the portfolios that not only survive but thrive amid global tensions.

References