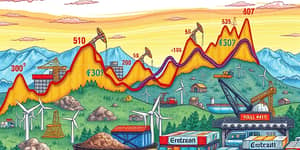

As the world steers decisively toward cleaner power sources, 2025 stands out as a milestone year. Global energy spending has soared to a record $3.3 trillion, with more than two-thirds—approximately $2.2 trillion—flowing into cutting-edge clean technologies. This seismic shift marks the most dramatic reallocation of capital since the industrial revolution, driven by robust policy incentives, plummeting technology costs, and strategic imperatives for energy security.

The surge in renewable investment is unprecedented. Solar photovoltaic (PV) emerges as the single largest recipient, attracting $450 billion in funding—outspending all fossil fuel categories combined. Nuclear energy also enjoys a renaissance, with investments surpassing $70 billion, a 50% leap over five years.

These flows are underpinned by major national programs such as the US Inflation Reduction Act and the EU Green Deal, which together have created a landscape of unmatched subsidy support and clear decarbonization targets. Advanced economies are witnessing a robust rebound in renewables, even as developing countries grapple with higher interest rates and geopolitical uncertainties that have caused investment dips.

Green subsidies have not only boosted large-scale deployments but have spurred a renaissance in domestic manufacturing. In the United States, quarterly clean manufacturing investments tripled between Q3 2022 and Q1 2025, driven by batteries, solar modules, and electric vehicles. Policymakers view these incentives as essential for strengthening supply chain resilience and reducing reliance on foreign producers.

The US battery industry, for example, now boasts a manufacturing capacity that exceeds current demand. If all planned facilities come online, the country could produce up to 6.84 million zero-emission vehicles annually by 2035—covering nearly two-thirds of forecasted sales. Similarly, domestic solar module output could satisfy roughly 55% of the panels needed for deep decarbonization within the next decade.

The green investment boom has reconfigured global capital flows. Traditional hydrocarbon hubs are ceding ground to regions with robust policy frameworks, lower capital costs, and growing power demand. China, for instance, delivers nearly double the renewable gigawatts per dollar invested compared to the US, reflecting efficient manufacturing and labor advantages.

Despite record investment, significant hurdles remain. Transmission grids are straining under the rapid influx of variable renewables, creating queues for interconnection and project approvals. Modernizing infrastructure requires substantial capital and coordination across jurisdictions—delays that could stall clean energy rollouts.

Moreover, capital efficiency disparities persist. Developing economies have seen a 31% drop in renewable inflows over the past year, hampered by rising risk premiums and policy uncertainty. Without urgent intervention, the global divide in energy access and decarbonization progress risks widening further.

As nations compete to attract green capital, the interplay between industrial policy and climate ambition intensifies. Policymakers are framing clean investments not only as environmental necessities but as pillars of economic resilience and growth. Green subsidies are expected to triple employment in the renewable sector by 2030, demanding new workforce training programs and education priorities.

Yet, even with historic spending levels, the world remains off track for the 1.5 °C climate target. Meeting that goal requires tripling global renewable capacity by 2030, a pace that current investments have yet to match. Aligning financial systems with climate risk is no longer optional; central banks and regulators increasingly view green finance as integral to macroeconomic stability.

Green subsidies are thus at the heart of a transformative moment. They are redirecting trillions of dollars, redefining industrial geographies, and recasting decarbonization as a strategic imperative for economies worldwide. While challenges in infrastructure, capital efficiency, and developing-world finance remain, the momentum is undeniable. The next decade will determine whether this record-breaking investment surge translates into tangible climate action and broad-based economic prosperity.

References