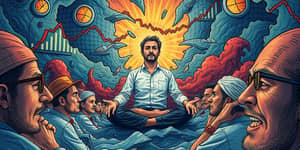

Market corrections can feel unsettling, but they are an integral part of the investment cycle. By understanding their nature and historical context, you can transform what seems like a setback into a strategic advantage. This article will provide you with insights, data, and actionable advice to help you navigate downturns with confidence and optimism.

Rather than viewing a correction as a threat, consider it a moment to recalibrate your portfolio, reinforce your strategy, and seize opportunities that arise at lower valuations.

A decline of 10% or more from a recent peak defines a market correction, yet it remains distinct from a bear market, which involves a 20%+ drop. Corrections serve as temporary pullbacks that correct prices back to longer-term trends after periods of rapid growth. They can unfold in stocks, indices, commodities, crypto, bonds, and real estate. Typically lasting three to four months, corrections are sharper and shorter than bear markets and often end when markets establish fresh highs.

Recognizing this pattern helps investors maintain perspective. Rather than reacting with panic, savvy market participants view corrections as opportunities to adjust positions, rebalance risk, and reinforce long-term strategies.

Since the early 1980s, the S&P 500 has experienced a 5% drawdown an average of 4.6 times per year, and a 10%+ correction every 1.2 years. In the last four decades, 64% of years saw at least one double-digit pullback, yet the long-term trajectory remained upward. During the dot-com bust (2000–2002), the index fell 51%, only to later rally over 100%. Similarly, the 2008 financial crisis saw a 58% decline followed by an 822% rebound.

These statistics highlight that corrections are a recurring, natural phenomenon. Awareness of this history equips investors to avoid emotional decision-making during volatile periods.

Multiple factors can spark a correction. Often, it is not a single event but a confluence of shifting market dynamics:

By monitoring indicators like the VIX (volatility index), earnings reports, and macroeconomic data, you can anticipate the potential for a pullback and position your portfolio accordingly.

Historically, markets rebound strongly after corrections. Since 1974, the S&P 500 has delivered an average annual 24% return following a pullback. This resilience underscores why corrections should be viewed not as endpoints but as springs for future gains.

To capitalize on these rebounds, consider the following approaches:

Diversification across sectors and asset classes can cushion volatility. Focus on companies with strong fundamentals, healthy balance sheets, and consistent cash flow. Avoid the temptation to time the exact bottom; instead, build positions over time.

Market corrections may challenge your nerves, but they also present unique openings. Whether you are a long-term investor or an active trader, corrections can improve your portfolio’s average purchase price and set the stage for substantial gains.

Remember that while many pullbacks occur, only a small fraction evolve into severe crashes. By maintaining discipline, leveraging historical insights, and adopting a clear strategy, you can navigate downturns with confidence. Ultimately, markets reward patience and resilience, rewarding those who remain calm and focused.

Next time you witness a significant market dip, pause and reflect: what opportunities lie beneath the surface? By mastering market corrections, you can transform volatility into a powerful ally on your path to financial success.

References