Managing money doesn’t have to be overwhelming. By following a straightforward approach, you can take control of your finances while still enjoying life and securing your future.

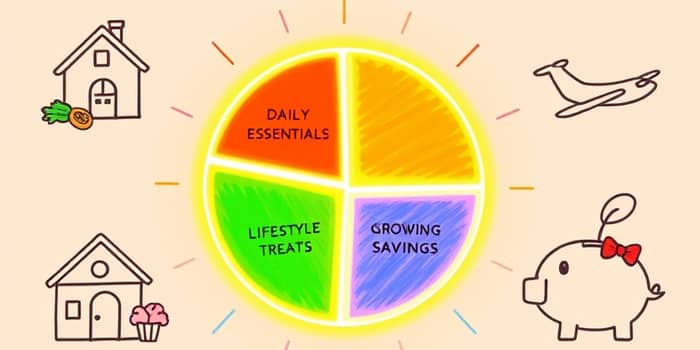

The 50/30/20 budget rule is simple personal finance strategy designed to divide your income into three clear categories. After accounting for taxes, you allocate:

• 50% to essential expenses

• 30% to lifestyle choices

• 20% to savings and debt repayment

This framework divides your after-tax income in a way that balances responsibility and enjoyment, removing the need for complex spreadsheets.

Each segment serves a unique purpose, ensuring that no aspect of your financial life is neglected.

Needs (50%) cover essential expenses you can’t live without. This includes rent or mortgage, utilities, groceries, insurance premiums, transportation costs, minimum debt payments, and basic medical bills.

Wants (30%) are discretionary expenses that enhance your day-to-day life. Think entertainment subscriptions, dining out, travel, hobbies, shopping sprees, gym memberships, and personal care services.

Savings and Debt Repayment (20%) focus on building your financial future. Contributions to an emergency fund, retirement accounts like 401(k)s or IRAs, extra loan payments, and investments all fit here.

Seeing real numbers can make this rule more tangible. Below are two typical scenarios for after-tax monthly income.

Using these guidelines, you can tailor the figures to match your own income and expenditure profile.

Transitioning to the 50/30/20 rule is easier when you follow clear actions:

Adopting this method brings multiple advantages:

It offers balanced money management by preventing overspending on non-essentials while making sure bills and future goals are covered.

By automating savings and debt repayments, you cultivate discipline, making progress toward an emergency reserve, retirement fund, or debt-free life.

The rule’s clarity can reduce financial anxiety, giving you confidence in both short-term decisions and long-term plans.

No two financial situations are identical. Adjusting the rule can help it fit your unique circumstances:

Maximize the impact of this budgeting method with real-world advice:

While powerful, the 50/30/20 rule isn’t one-size-fits-all. It may not suit those with erratic income streams, excessive debt obligations, or living in extremely high-cost areas. In such cases, combine this model with a customized plan that addresses special expenses like self-employment taxes or large family needs.

Adopting the 50/30/20 budget rule provides clarity and direction for your financial journey. By dividing your money into essential expenses, lifestyle enjoyment, and future growth, you create a roadmap that adapts as your life evolves. Embrace this structure to cultivate financial peace of mind and unlock the freedom to pursue both daily pleasures and long-term dreams.

References