In a world where chance encounters often masquerade as strategy, mastering the art of calculated risk-taking can spell the difference between sustainable growth and reckless failure. This article unpacks the principles, tools, and mindset that define a true calculated risk-taker, and offers actionable guidance for seizing opportunities with confidence.

A calculated risk is a carefully considered decision that exposes one to personal or financial exposure counterbalanced by a reasonable possibility of benefit. It involves systematically evaluating potential outcomes, gathering relevant information, weighing potential rewards vs potential losses, and acting only if the upside reasonably justifies the downside.

In contrast, a reckless gamble leaps forward on gut feeling alone, without a clear understanding of maximum loss, probabilities, or contingency plans.

Avoiding all risk can stall innovation and hinder growth. Success in business and life often depends on moving beyond the comfort zone with confidence and preparation. Calculated risk-taking:

Understanding how much risk to take begins with clear definitions. Risk appetite describes how much uncertainty an organization is willing to accept in pursuit of reward. Risk tolerance is the maximum negative effect one can endure before it becomes unacceptable. Risk threshold marks the point at which potential loss outweighs potential gain.

Executives can refine these boundaries by asking key questions:

The risk–reward ratio is a core tool for informed decision-making. It is calculated by dividing expected net profit by maximum potential loss. For example, if an upgrade costs $100 and is forecast to generate $500 in extra revenue, the ratio is 5:1 (500 ÷ 100). This simple metric helps determine whether an opportunity aligns with risk thresholds.

For more nuanced decisions, calculate expected value by multiplying potential reward by success probability. Consider a product launch with an expected profit of $200,000 and a success probability of 40 percent. The expected reward is $80,000 (200,000 × 0.4). If development and marketing costs amount to $50,000, the risk–reward ratio based on expected value is 1.6:1 (80,000 ÷ 50,000). Companies then compare this figure to their appetite to decide if the launch proceeds.

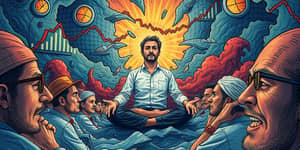

Beyond metrics and models, calculated risk-takers cultivate a mindset that balances courage with caution. Self-awareness enables recognition of personal biases and true tolerance. Self-regulation ensures adherence to criteria rather than impulsive decisions fueled by fear or excitement. Empathy guides consideration of stakeholders, from employees to customers, ensuring decisions account for wider impacts. Strong social skills help communicate trade-offs and rationales effectively, securing buy-in and support.

Avoiding overconfidence bias and loss aversion paralysis is critical. Combining data analysis with informed intuition fosters balanced judgments, while structured frameworks prevent emotional swings from derailing plans.

Philosophers distinguish risk from chance by the extent to which outcomes can be estimated or bounded. Risk involves frameworks, analysis, and intentional limits. Chance is action without design, subject to unknown downsides and unquantifiable probabilities. A calculated risk-taker builds tools and processes to ensure decisions rest on estimating both likelihood and impact, thereby avoiding pure gambles that lack foundation.

Embracing calculated risks empowers individuals and organizations to pursue bold initiatives with confidence. By systematically evaluating outcomes, quantifying trade-offs, and managing emotions, any leader can convert uncertainty into opportunity, forging a path toward sustainable success.

References