In a world of constant consumption, finding balance between desire and discipline can transform your finances.

Frugal living is more than just cutting costs—it is a deliberate path toward long-term wealth and freedom.

At its core, frugal living means embracing making every dollar count by aligning spending with your priorities.

It is a myth that frugality equates to deprivation; instead, it is about maximizing value, reducing waste, and gaining peace of mind and security.

Adopting frugal habits delivers rewards beyond a padded bank account. You gain:

Every journey starts with awareness. To uncover hidden spending, track every dollar religiously for at least thirty days.

Then choose the approach that fits your style:

The impact can be dramatic. Many people find over $200 leaking out monthly on small, forgotten purchases.

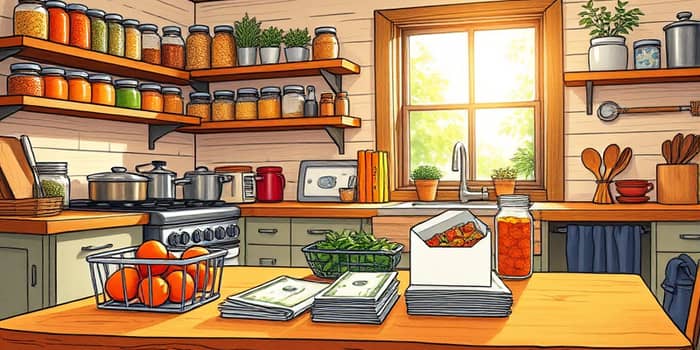

Grocery bills often account for a large share of monthly expenses. Smart meal planning can cut costs significantly.

Households often save hundreds each month by combining these simple strategies.

Before you buy, calculate the cost per use analysis to guide decisions on clothing, tools, or electronics.

Opt for high-quality items that last, consider refurbished or secondhand goods, and borrow or share resources whenever possible.

Leverage seasonal sales, cashback programs, and reward points—but never buy solely because it is on sale.

Small changes can yield big savings in your home. Lower your thermostat by a few degrees, switch to LED lighting, and fix leaky faucets.

Upgrading to energy-efficient appliances can reduce utility bills by up to 20%. Implementing water-saving habits further eases monthly costs.

Once your spending is streamlined, establish an emergency fund covering three to six months of expenses in a separate account.

Then automate savings and investments to ensure consistent contributions toward retirement or growth portfolios.

Consider user-friendly platforms that invest spare change or offer diversified, low-cost funds, focusing on long-term financial growth strategies over quick gains.

Frugality is a mindset, not a temporary diet. It invites you to live with purpose, seeking satisfaction beyond material accumulation.

By choosing experiences over things and cherishing simplicity, you cultivate lasting joy and appreciation for what truly matters.

Nicole, a busy professional, began tracking expenses and cut impulse purchases by 50%, redirecting $300 each month into savings.

A family of four embraced shelf cooking and envelope budgeting, reducing their grocery bill by $400 and feeling more in control.

To begin today:

Record every expense you make in a notebook or app.

Identify one area to trim spending—like dining out or utilities.

Set up automatic transfers to savings to build your emergency fund.

Frugal living is a journey of empowerment. By making thoughtful choices, you can save more, spend smarter, and build a secure future.

Begin with small steps, celebrate every win, and watch as intentional habits transform your financial life.

References