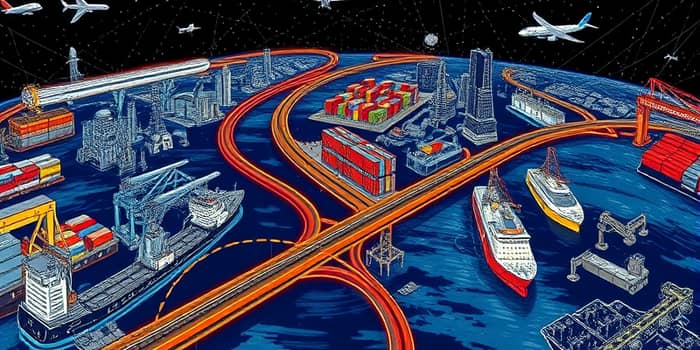

As the world navigates the challenges of urbanization, trade tensions, and climate urgency, global transportation investment emerges as a beacon of progress and connectivity. By understanding where capital flows, the forces propelling it, and the technologies it fuels, stakeholders can unlock transformative gains in mobility.

Across OECD and ITF nations, spending on inland transport infrastructure as % of GDP spans a vast spectrum—from just 0.1% in Ireland to nearly 3% in Azerbaijan. These disparities reflect both the maturity of networks in advanced economies and the catch-up investment in emerging markets carving new arteries of growth. A PWC/Oxford Economics study projects transport infrastructure investment to grow an average of 5% annually from 2014 to 2025, laying the foundation for resilient, interconnected systems.

Asia-Pacific leads with nearly USD 900 billion in annual spending by 2025, while Sub-Saharan Africa achieves the fastest growth rate—exceeding 11% per year—driven by urgent needs for basic connectivity. Latin America’s road budgets surge by roughly 11% annually, and the Middle East doubles its road investment to USD 31 billion per year. Meanwhile, mature markets in Western Europe and North America see more modest growth under fiscal constraints.

Despite long-term momentum, cyclical headwinds temper near-term sector output. Global transportation and logistics output is forecast to grow 2.5% in 2025 and 2.4% in 2026, down from earlier 4.3% and 3.7% expectations amid softer trade and rising tariffs. Regional outlooks diverge sharply.

This snapshot illustrates both the promise of high-growth markets and the pressures on established economies grappling with supply chains, labor shortages, and tariff volatility.

Each region tells a unique story of ambition, constraint, and opportunity. Investors must align strategies with local priorities to maximize impact and returns.

The shape of tomorrow’s mobility depends on targeted capital allocations across roads, rail, ports, and airports. Each mode faces distinct challenges and innovations.

Innovation reshapes how we move people and goods. From expanded public-private partnerships to digital freight platforms, new models unlock efficiency and resilience. In China, the USD 205 billion transportation PPP program attracts diverse capital sources into rail, road, and logistics hubs.

Meanwhile, smart infrastructure—equipped with IoT sensors, predictive maintenance algorithms, and dynamic tolling—enables real-time network optimization. Autonomous vehicles and drone delivery pilots point to a future where last-mile linkages become faster and greener. Collaboration among governments, operators, and tech providers will be vital to scale these experiments.

Despite robust fundamentals, investors face obstacles. Trade tensions and tariff shifts can erode freight volumes. Labor shortages and rising material costs inflate project budgets. Regulatory frameworks around emissions and procurement often lag technological capabilities, delaying deployments.

Environmental and social considerations add complexity. Communities demand equitable access and minimal ecological impact, requiring rigorous planning and stakeholder engagement. Funding uncertainties in developing markets call for blended finance and risk-sharing mechanisms to de-risk large projects.

As global mobility investment gathers pace, the stakes extend beyond returns. Each highway, rail line, port expansion, or airport upgrade is a promise of greater economic opportunity, social inclusion, and environmental stewardship. By harnessing data-driven planning, innovative financing, and cross-sector collaboration, the world can build transport systems that connect communities, empower businesses, and reduce carbon footprints.

Now is the moment for policymakers, investors, and operators to unite around a shared vision: one where sustainable mobility underpins resilient economies and inclusive growth. As capital flows into dynamic markets and emerging technologies, we stand on the brink of a new mobility century—one defined by smart networks, seamless connections, and unwavering commitment to a better tomorrow.

References