Central banks stand at the heart of global economic stability, wielding powerful instruments that shape everything from bond yields to equity valuations. Their policy moves reverberate across borders, prompting investors, corporations, and governments to adjust strategies in real time.

Understanding the full scope of these decisions demands a deep dive into the tools, mechanisms, and market linkages at play. This article explores how interest rate shifts, unconventional measures, and emerging innovations like digital currencies send ripples through global markets.

At the core of every monetary authority’s arsenal lies a comprehensive monetary policy toolkit. This includes benchmark interest rates, open-market operations, reserve requirements, and more recently, experimental approaches such as digital currency issuance.

Policy targets typically revolve around four pillars: inflation control, sustainable economic growth, employment maximization, and financial stability. By calibrating these instruments, central banks aim to anchor expectations, guiding consumer behavior and investment decisions.

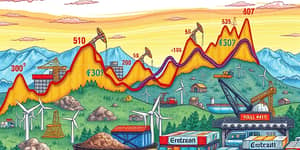

In 2025 to date, major central banks have taken varied approaches in response to evolving growth and inflation dynamics. Below is a snapshot of key rate settings and recent changes.

While the Fed and BOJ held rates steady, the ECB and BOE each implemented back-to-back cuts of 25 basis points—the BOE’s first such sequence since 2009. Inflationary pressures remain, with the UK’s harmonized inflation rate at 3.4% year-over-year in March 2025.

Market expectations now price in a high probability of Fed easing later this year, even as headline data remains mixed. Investors weigh each central bank’s stance against growth forecasts and labor market resilience.

Central bank decisions propagate through a series of well-understood channels. At the policy level, shifts in benchmark rates directly affect borrowing costs, while signaling alters expectations for future growth and inflation.

These mechanisms interact, creating complex feedback loops. For example, a weaker currency may stoke import-driven inflation, complicating policy decisions and testing central banks’ ability to maintain long-term inflation expectations.

The Federal Reserve’s policy path often sets the global tone. U.S. Treasury yields serve as benchmarks for sovereign and corporate borrowing worldwide. Consequently, Fed rate hikes tend to tighten financial conditions even in economies holding rates steady.

Meanwhile, the ECB and BOE influence euro and pound dynamics, affecting cross-border capital flows within Europe. Japan’s persistently low rates stand as an outlier, reinforcing carry trades into yen-denominated assets. Such divergences create both opportunities and challenges for multi-asset investors seeking coordinated international policy responses.

When traditional tools reach their limits, central banks turn to unconventional measures. The legacy of large-scale asset purchases in 2020–2023 underscores the potency—and potential side effects—of quantitative easing.

Adoption of central bank digital currencies could alter reserve management, influence liquidity conditions, and require new regulatory frameworks. Policymakers will need to balance innovation benefits against risks to the traditional banking model.

Looking forward, volatility is likely to remain elevated as markets react to the ebb and flow of hawkish and dovish signals. Divergent stances among major central banks will enrich opportunities for active managers who excel at active management and fundamental analysis.

In an era marked by rapid technological change, geopolitical tensions, and shifting inflation dynamics, investors and institutions must embrace rigorous scenario planning and stress testing. By developing robust strategies that account for policy uncertainty, market participants can position themselves to benefit when central banks chart new territory in 2025 and beyond.

References