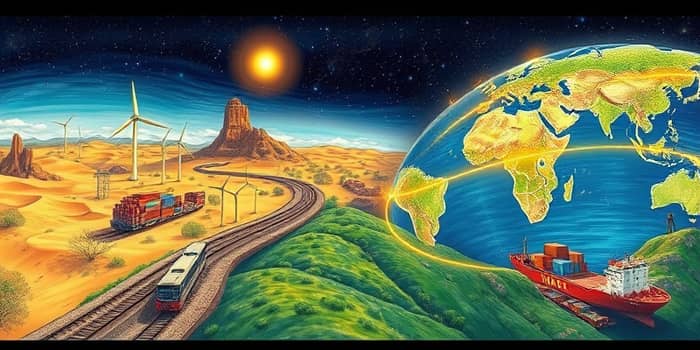

The New Silk Road, known as the Belt and Road Initiative (BRI), stands as a monumental testament to modern connectivity. Launched in 2013, it reimagines historic trade routes and channels vast capital across continents. From investment in energy to digital corridors, the initiative is rewriting the rules of global finance and infrastructure.

For centuries, the ancient Silk Road wove together merchants, ideas, and cultures across Asia and Europe. Its caravans carried silk, spices, and porcelain; they also transported knowledge and innovation between East and West. Today, the modern Silk Road draws inspiration from that legacy, seeking to revive networks that once bridged civilizations.

Under President Xi Jinping’s leadership, China unveiled a global infrastructure and investment strategy designed to foster inclusive growth. This vision marries cultural heritage with cutting-edge project planning, from highways crisscrossing deserts to undersea cables powering data exchange. By embracing both tradition and technology, the BRI aims to create a world where opportunity flows as freely as goods.

Encompassing the overland “Silk Road Economic Belt” and the sea-based “21st Century Maritime Silk Road,” the initiative now spans up to 150 countries. Collectively, these nations represent two-thirds of the world’s population and about 40% of global GDP, making the BRI one of the largest cooperative frameworks in history.

Recently, China has underscored green and high-quality development as core principles. Projects increasingly feature renewable energy, adherence to environmental standards, and a focus on sustainable returns. By blending ambition with responsibility, the BRI seeks long-term resilience alongside economic gains.

Since 2013, cumulative BRI engagement has surpassed USD 1.053 trillion. In 2023 alone, deals totaled USD 92.4 billion—an 18% increase over the previous year. Investments comprised more than half of this figure, signaling a shift toward energy and green transition initiatives and direct enterprise participation.

Directional shifts are shaping the landscape. Africa emerged as the top recipient region in 2023, overtaking the Middle East. Private Chinese enterprises now lead in investments, while state-owned enterprises focus on construction contracts. These trends illustrate evolving risk appetites and strategic priorities.

World Bank analyses suggest full implementation of transportation corridors could boost global trade by 1.7–6.2% and increase real income by 0.7–2.9%. Projections indicate a potential rise in global GDP by up to USD 7.1 trillion by 2040, transforming economies and livelihoods across continents.

By lowering logistical barriers, harmonizing regulations, and financing new routes, the BRI is carving a path toward a more interconnected market. Yet, the distribution of these gains depends on thoughtful policy design and robust project management at every level.

Despite promising statistics, the initiative faces criticism over debt sustainability and governance. Some recipient countries encounter financial strains when projects underperform or lack transparency. These risks underline the need for rigorous due diligence and community engagement in every undertaking.

China has responded with guidelines emphasizing ecological civilization within BRI investments and stricter standards. Enhanced governance frameworks, risk-sharing clauses, and local stakeholder input are now prerequisites for many projects. Such measures aim to balance growth with accountability and long-term viability.

Whether you are a business leader, investor, or policymaker, opportunities abound along the New Silk Road. Success hinges on collaboration, informed decision-making, and sustainable practices. The following approaches can help you navigate this dynamic environment:

By integrating local insights and global expertise, stakeholders can unlock mutual benefits, drive innovation, and foster resilient communities. This collaborative ethos not only mitigates risk but also enhances social license to operate.

As the BRI evolves, new themes are emerging on the horizon. Digital Silk Road projects are expanding data connectivity, while cross-border rail, highways, pipelines, ports converge to create multi-modal corridors. Strategic resource-backed deals in mining and battery technology underscore the shift toward high-value industries.

In 2024 and beyond, we can expect heightened growth in renewables, ICT, and manufacturing technologies. Initiatives will increasingly weave people-to-people cultural exchanges into their core missions, fostering deeper understanding and shared prosperity. By championing innovation and inclusivity, the modern Silk Road promises to be more than a network of roads and rails—it will be a living symbol of global partnership.

Ultimately, the New Silk Road offers a roadmap for economic revitalization, sustainable development, and cross-cultural collaboration. By harnessing its potential responsibly, we can build a future where capital flows not just for profit, but for the collective progress of all nations and communities involved.

References