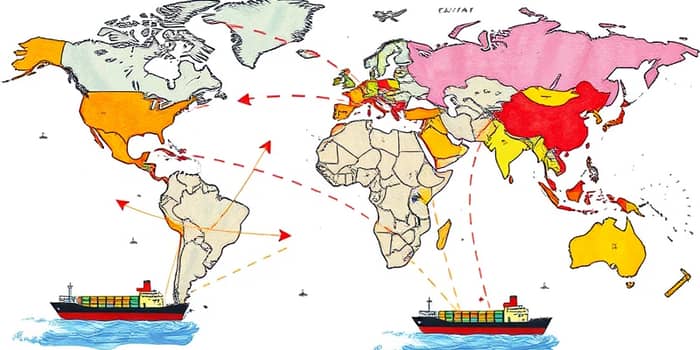

Since 2020, global commerce has faced unprecedented disruption across global networks. The COVID-19 pandemic, geopolitical tensions and logistical bottlenecks forced companies and governments to rethink decades-old trade patterns.

This seismic shift is moving the focus from an efficiency-obsessed model to one that prioritizes resilience and economic security. As supply chains reconfigure and new corridors emerge, businesses and nations are navigating a transformed landscape.

Traditionally, supply chains operated on a "just-in-time" basis, minimizing inventory and optimizing costs. However, widespread lockdowns, port closures and fluctuating demand exposed the fragility of this approach.

In response, many organizations have adopted just-in-case inventory and redundancy measures. By holding higher safety stocks and diversifying suppliers, companies aim to withstand unexpected disruptions without halting production.

Rising U.S.–China tensions, the Russia–Ukraine war and evolving tariff policies have reshaped where goods travel and who they pass through. Companies are seeking to reduce exposure to any single country or route.

A rising Global South is filling gaps left by traditional suppliers. ASEAN members, India, Brazil and African nations are evolving from commodity exporters into manufacturing and logistics centers.

These markets benefit from lower labor costs, improving infrastructure and government incentives aimed at attracting foreign direct investment.

To manage risk, companies are implementing a range of measures that go beyond inventory buffers. Digital visibility tools, scenario planning and multi-sourcing partnerships are now critical.

Some of the leading tactics include:

Despite these shifts, overall trade growth is expected to slow marginally from 2.9% in 2024 to 1.1% in 2025, according to the IMF’s World Economic Outlook.

Over the next decade, however, total merchandise trade is projected to expand at an annual rate of 2.9%, with the composition of corridors changing dramatically.

The cost of transportation and inventory holding has increased, contributing to permanently higher consumer prices in several sectors. Companies must decide how much of these costs to absorb or pass on to end users.

Businesses that invest in resilient networks and digital tools will gain competitive advantages through faster response times and reduced downtime.

The realignment of trade routes marks a pivotal moment in global commerce. Companies and nations that embrace diversified, resilient supply chains will be better positioned to weather future shocks.

By prioritizing economic security and strategic flexibility over narrow cost-cutting, stakeholders can build networks that are robust, adaptable and aligned with shifting geopolitical realities.

As the world continues to evolve, staying informed and agile will be key to thriving in this new era of trade.

References