As the world undergoes an unprecedented shift toward city living, investors, policymakers, and communities must navigate both the promise and the complexities of this transformation. More than 4 billion people now reside in urban areas, shaping the future of real estate and demanding innovative solutions. This article explores the trajectory of urbanization, the forces driving it, regional variations, and the most compelling opportunities for stakeholders to harness sustainable growth.

Urbanization is a remarkably recent phenomenon. In 1800, only 8% of humanity lived in cities. Industrialization, infrastructural breakthroughs, and economic development fueled a rapid shift over two centuries. By 2007, for the first time in history, the global urban population surpassed its rural counterpart.

Today, cities host approximately 58% of the global population, a figure projected to rise to nearly 70% by 2050. These numbers highlight a fundamental demographic tipping point and set the stage for profound changes in land use, housing demand, and economic patterns worldwide.

Understanding why people flock to cities sheds light on real estate dynamics and investment priorities. Economic opportunities remain the primary magnet, with urban centers offering diverse employment in sectors like finance, manufacturing, and digital services. Education and healthcare access further solidify cities as engines of upward mobility.

Urban migration is both internal—rural to metropolitan areas—and international. In many economies, smartphone penetration exceeding 89% in cities accelerates digital services adoption and supports growth in co-living, e-commerce, and tech-enabled infrastructure.

Urbanization varies significantly across regions, creating differential risks and rewards for real estate investors.

Asia and Africa are the engines of future urban growth, expected to absorb 90% of new urban dwellers. India, China, and Nigeria alone will contribute 35% of the global increase by 2050. In contrast, developed regions face challenges of aging infrastructure, high property costs, and the need for urban renewal.

The influx of billions into cities generates urgent needs and lucrative prospects. Residential demand is soaring: an estimated 1.6 billion people currently lack adequate housing, a figure that could swell to 3 billion by 2030. Investors and developers can capitalize on this gap by focusing on affordable and sustainable housing solutions in emerging cities.

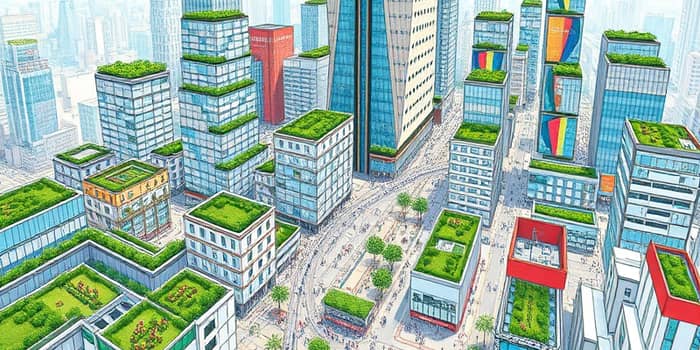

Commercial real estate in fast-growing markets offers robust returns as service industries and retail flourish. Industrial logistics hubs near urban centers support e-commerce growth. Mixed-use complexes that blend residential, office, and leisure functions meet modern urbanites’ expectations for convenience and connectivity.

Rapid city growth brings significant hurdles that can undermine investment returns and community well-being. Infrastructure strain—on transportation networks, water supply, and energy systems—requires massive capital infusion and strategic planning. Urban inequality, manifested in slums and unaffordable housing, raises social risks and political pressures.

Environmental concerns such as urban sprawl, resource depletion, and climate vulnerability demand sustainable and climate-resilient buildings. Public-private partnerships and innovative financing models can mobilize resources to upgrade utilities and preserve social cohesion.

Technological advances are redefining what cities can be. Proptech platforms streamline property management, while AI-driven analytics optimize site selection. State-of-the-art proptech innovations empower stakeholders to monitor asset performance in real time and anticipate market shifts.

ESG considerations are integral to modern real estate. Tenants and investors increasingly prioritize energy efficiency, green certifications, and social impact. Smart city initiatives—deploying IoT sensors, data-driven traffic management, and renewable energy grids—offer competitive advantages in attracting businesses and residents.

To seize urbanization opportunities, stakeholders should adopt a multifaceted approach:

First, pursue mixed-use and high-density projects near transit corridors to maximize land use and minimize congestion. Second, integrate affordable housing quotas and community amenities to foster inclusive growth. Third, collaborate with local governments on resilient infrastructure planning, ensuring reliable utilities and climate adaptation measures.

Finally, build flexibility into developments—modular offices, co-living spaces, and convertible floor plans—catering to evolving work and lifestyle preferences. Embracing advanced smart city infrastructure will future-proof investments and enhance quality of life for urban residents.

Urbanization is an unstoppable global force, reshaping demographics, economies, and real estate markets. From historical milestones to projections of 7 billion city dwellers by 2050, the scale of change presents both challenges and unprecedented opportunities.

By prioritizing sustainability, inclusivity, and technological integration, investors and policymakers can unlock the full potential of urban landscapes. Strategic collaboration, innovative financing, and a steadfast commitment to resilient design will ensure that cities of tomorrow are vibrant, equitable, and enduring hubs of human progress.

References